How to Read 10-Ks Quickly & Confidently

Turbo through 10-Ks during 10-K season with tips & technology from VerityData.

How do you read a 10-K quickly and confidently, so you can update your thesis, make a recommendation, and/or take a position sooner than others do?

The amount of raw data included in 10-K filings has steadily increased over the last 25 years. From 23,000 words in 1996 to 50,000 in 2013, with some filings reaching more than 100,000 words today.

The average length of a company’s 10-K filing is almost as long as The Great Gatsby. Let that sink in http://t.co/3XWvcOfKMr

— David Biderman (@DavidBiderman1) June 2, 2015

There’s more to know but there’s also more to ignore: 10-Ks are filled with unchanged and/or boilerplate language that isn’t worth your attention.

In this article, we’ll cover a few use cases showing how to catch up on a 10-K and find new ideas quickly with VerityData inFilings. Specifically,

- What disclosures warrant scrutiny?

- What do the changes mean?

- Is it trending positively or negatively?

With VerityData financial research software, analysts can very quickly see what companies are making changes, what changes were made, and the extent of those changes. You can search for what matters and discover ideas you might have missed.

What’s Happening Across the Tickers I’m Tracking?

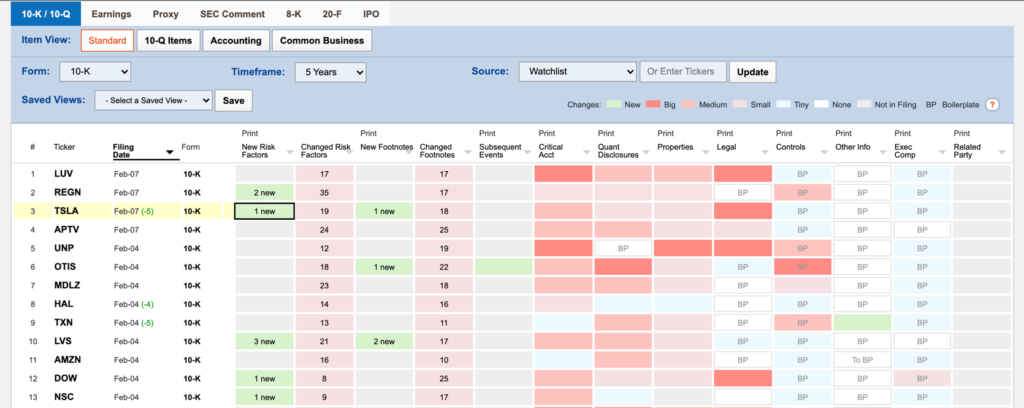

One of the different things about VerityData is the attention we pay to cleaning and structuring disclosures so that the data can be seen and screened in meaningful ways. For example, you can compare 10-Ks by industry (industrial goods in the example below) or set up a custom watchlist.

Color-coded heatmaps visualize the change so analysts can quickly understand:

- What is new (green).

- Where there are big changes (dark red).

- Where there are no changes (grey).

- What is boilerplate (white BP).

- And gradients in between.

See something interesting? Click any of the cells to get more granularity right away.

What Are the New & Changed 10-K Risk Factors?

Notice that we’ve prioritized new and changed risk factors by default so you can stay on top of one of the most important disclosures.

As noted by Christopher Bartel, head of global equity research at Fidelity Investments, “If there’s a [risk factor] change, that’s because the lawyers told them they had to put that in there.”

In this example, we’ve clicked on a new Risk Factor disclosed by FB regarding the metaverse to get full text of the new risk.

Has the Company I’m Researching Changed Anything? What?

When looking into specific companies, you quickly access a 10-K heatmap, along with callouts for other essential research inputs available in inFilings: earnings transcripts, proxies, and more.

Some analysts rely on search software to find important 10-K changes. As we all know, if you’re going to search for something you have to know what you’re looking for.

How Have the Company’s Disclosures Changed Precisely?

We’ve invested heavily into the redlining capabilities to make it one of the best available for institutional investors. In the example below, redlines and highlights help analysts focus on seeing what’s changed so they can spend more time on analysis. Notice even the percent change is calculated automatically.

How Is a 10-K Changing Over Time?

VerityData inFilings lets you compare historical filings (up to the last 8 years) side by side with redlines. You can quickly note:

- Changes in language and tone. See our blog on lazy prices for more on how a 10-K can foreshadow future gains or, in the case with ZG in 2021, future drops.

- Updates to financial figures.

- Frequency of changes. A company that is constant changing a position is not a good sign.

- Changes to prioritization. For example, has the priority of risks changed in a meaningful way?

How Does X Company 10-K Compare to Y Company?

You can also easily compare 10-Ks across companies. For example, the view below comparing instances of the word “supply” between two competitors to understand how they are addressing potential supply chain issues.

What’s Happening on X Topic?

You may have a sense of what you’re looking for. The sophisticated search in Verity lets you mine 10-Ks and other filings by topic or keyword, giving intelligent recommendations.

When searching CARES Act, for example, you can target that specific keyword or, as the dropdown suggests, search everything stimulus related.

The results of a search give the context and granularity you need to dive deeper on the topics. You can also restrict search results to specific sections and results that have ‘content’ or have changed.

Bottom Line

If you are using the SEC’s EDGAR portal or other basic redlining software, you’re going to spend a lot of time trying to understand what has changed. At Verity, we structure 10-Ks so you know immediately what’s new and what has been modified. Features like advanced search and screening speed up idea generation. Regular summary reports, delivered to your inbox, make it easier to monitor your list.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo