Unusual Insider Buying at $VRNS, $IAC, $CZR While Overall Activity ‘Muted’

A summary of notable insider trading activities from Verity’s research team.

In Brief

- Overall, November insider buying volume was typical.

- Non-10b5-1 selling, which becomes more widespread as trading windows open, was low.

- Selling was low too but that’s normal and aligns with the seasonal flow.

- As a result, sentiment was tilted very slightly in a positive direction.

Putting November in Context

The second month of the quarter is typically the heaviest in terms of insider trading volume, but insider activity in November remained fairly muted (continuing a theme we’ve observed throughout 2022).

Roughly 800 insiders bought shares of their companies in November — almost exactly in line with the number of buyers in the second month of Q3’22 — but fewer than the approximately 1,000 insiders who bought in November 2021. The ~1,250 unique non-10b5-1 sellers in November 2022 were slightly lower than in August 2022 and well below the ~1,500+ who sold in November 2021.

Taken together, the ratio of sellers to buyers ended up 1.58:1, slightly below the average ratio of monthly sellers to buyers at 1.65:1.

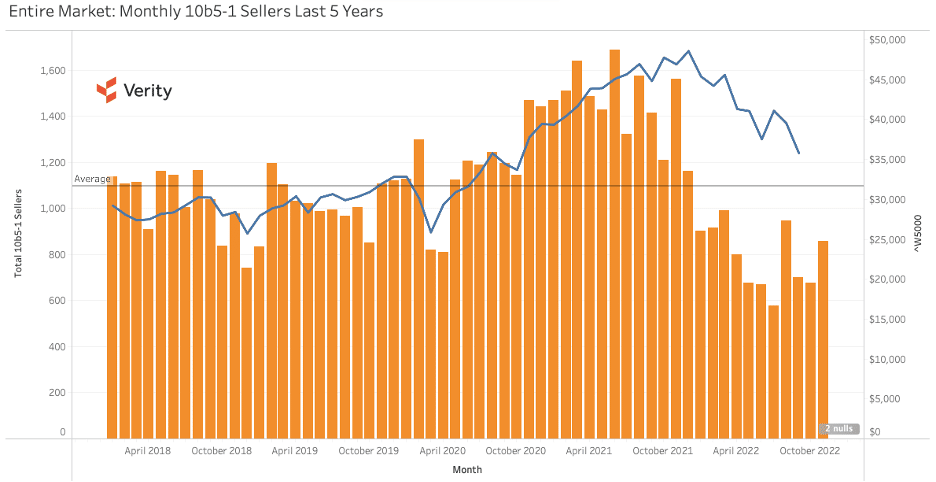

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

+ IAC (IAC) – Director Michael Eisner, who was previously CEO of Disney (DIS) for nearly 22 years, returned as a buyer at $47.13, sending a strong undervalued message at the internet media company. Eisner has deep pedigree in the entertainment industry through his years at DIS and ABC before that. Listed as a billionaire according to Forbes, Eisner has deep pockets for seven-figure buys. However, he’s rarely bought in the past and his limited track record proved timely before, including another $5.0M buy in August 2020. (11/28/22)

+ Caesars Entertainment (CZR) – A director with a history of primarily timely purchases at the casino and resort operator spent $1.1M to buy at $44.74. Director Michael Pegram has been opportunistic in the past as he bought amid price troughs in 2016, 2018, and 2019. Outside of his March 2022 purchases, Pegram has shown a penchant for opportunistic buying and his return with the stock trading at ~2-year lows was notable, especially as he transacted his largest buy by dollar figure to date at CZR and its predecessor firm. (11/8/22) Get Full Story >>

+ Varonis Systems (VRNS) – Purchases at ~$16.70 by three top executives and a director at the cybersecurity firm represented a compelling display of conviction and positive insider sentiment. James O’Boyle, SVP of Worldwide Sales, set the pace with a $1.0M buy at $16.72, while CEO Yakov Faitelson and CFO Guy Melamed were also buyers. The trio of executives reversed sentiment after each was a seller in 2021. (11/8/22)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

For access, request a free trial of VerityData >>

For data inquiries relevant to this report, contact Ben Silverman.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo