January 11, 2023

What Happened in 2022? Insider Transaction Data Reveals New Record, Unusual First

2022 gave us a new record low for insider selling; marked the first major drawdown in the 21st century where insiders sat out rather than bought the dip. December saw unusual activity from insiders at TSLA, NRG, and HZNP.

In Brief

- Market-wide correction depressed insider selling to the lowest level in +18 years.

- But insiders did not call a bottom with the type of broad-based buying witnessed at other market bottoms during the period.

- Look for insiders with strong transactional histories or deviations in selling behavior.

- Despite annual unique sellers being unusually low in 2022, the dollar value of shares sold was close to the amounts seen before 2020.

- December saw unusual activity from insiders at TSLA, NRG, and HRZN.

Insiders Hedged in 2022

Insiders hedged in 2022, showing an unwillingness to call a market bottom by buying en masse (as we’ve seen during other turbulent market periods) while also deviating from their long-displayed behavior of regularly turning stock-based compensation into cash. This behavior suggests a cautious near-term outlook (stocks have more room to move down so wait for a better price) and rosier long-term outlook (sit on stock-based comp until stock prices rebound).

Unlike Earlier Market Drawdowns

During other substantial market drawdowns since 2004, insiders have stepped into the void and bought aggressively. In doing so, they perfectly nailed the false bottom of November 2008 and the market bottoms of 2009 (Great Financial Crisis), 2011 (U.S. credit downgrade), 2016 (banking woes), and 2020 (Covid-19 Pandemic).

What Does It Mean for Investors?

Focus on companies where there is insider buying from insiders who have strong transactional track records and companies where insiders have displayed significant deviations in selling behavior (ex. a total stoppage in insider selling at a company with a long history of consistent insider selling).

Related: 2022 Insider Hotlist: Best & Worst Performers Ranked

2022 By the Numbers

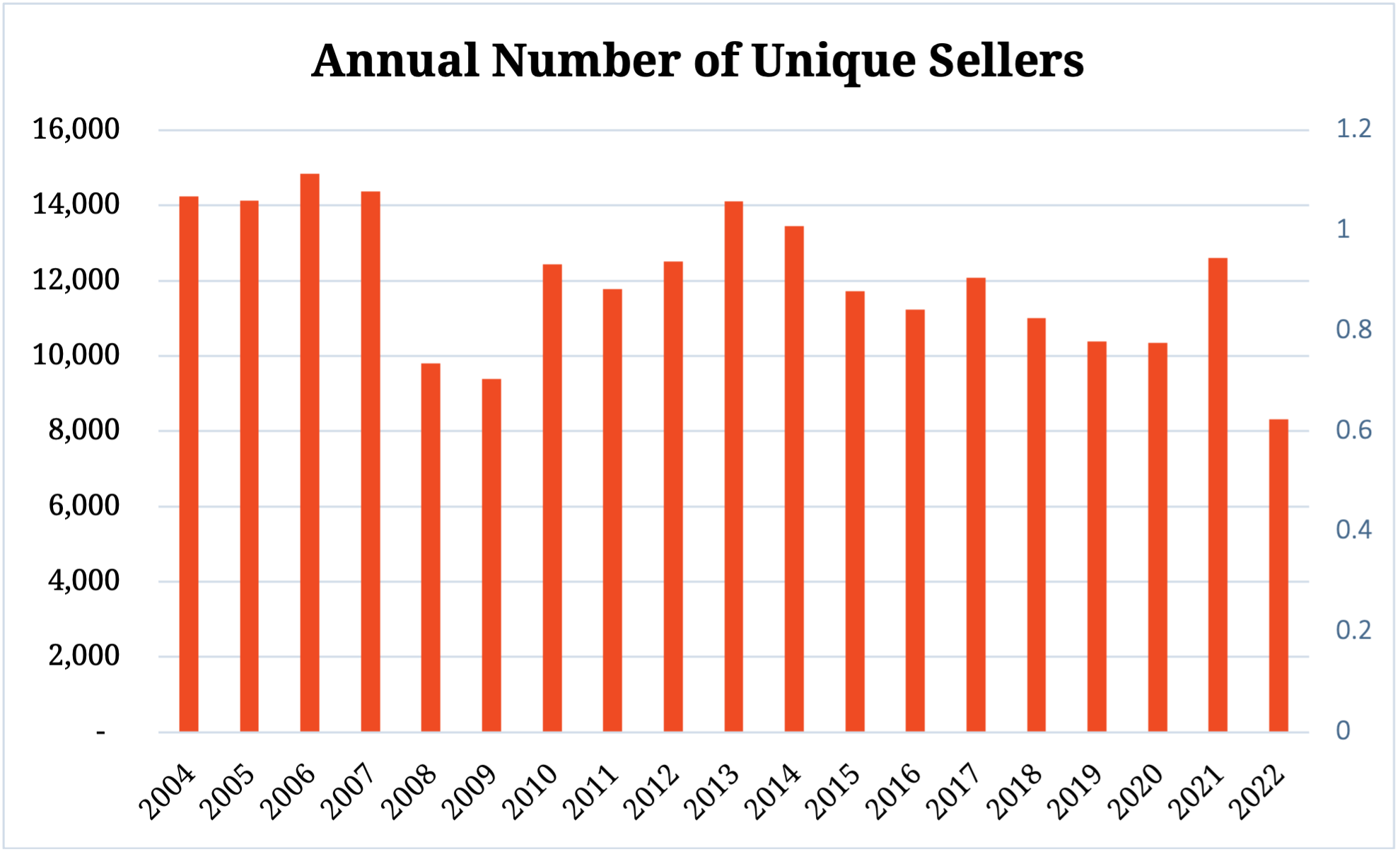

- The 8,310 unique insider sellers are the lowest total during our record period. The previous low was 9,398 in 2009.

- Year-over-year, the number of unique insider sellers fell -34.0% from 12,600 in 2021, when the number was the highest since 2014.

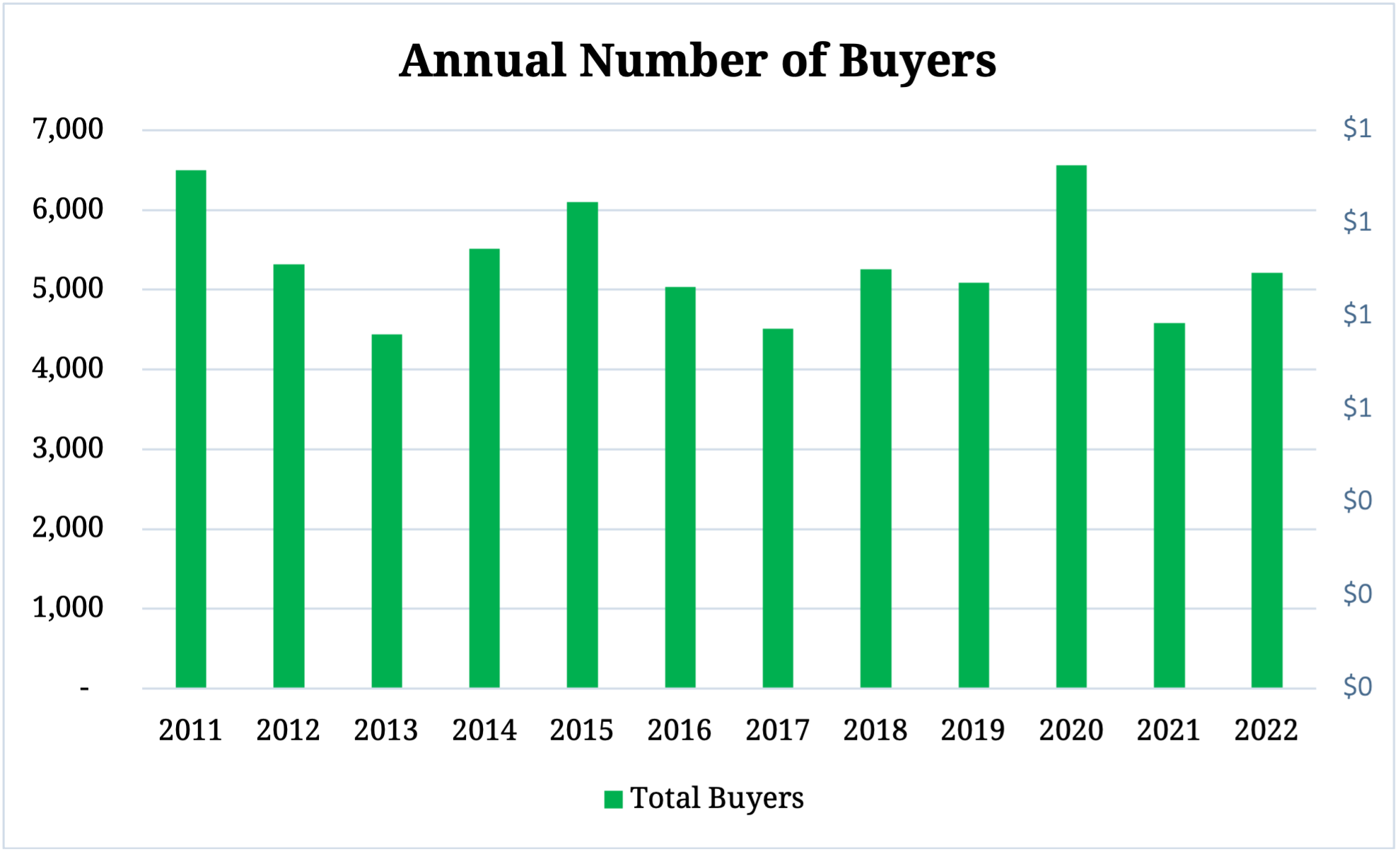

- The 5,216 unique insider buyers in 2022 represented a 13.9% YoY increase but compared to 6,563 in 2020. The high during our record period is 9,545 in 2008.

- The number of unique insider buyers in 2022 was the fourth-lowest total for any year during our record period (lower years were 2021, 2017, 2013 and 2004).

- The total dollar value of insider sales was $61.96 billion, down from a record $167.269 billion in 2021. It was the lowest dollar value since 2016.

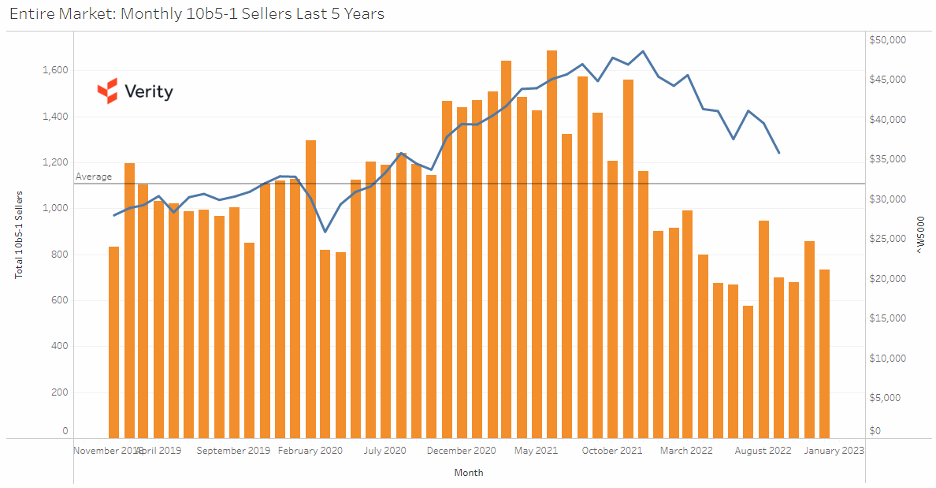

- The percentage of sale transactions conducted via Rule 10b5-1 plans fell YoY to 58.2% from 60.4%. This was the first time since 2016 that 10b5-1 plan usage fell.

Source: VerityData

Source: VerityData

Despite annual unique sellers being unusually low in 2022, the dollar value of shares sold was close to the amounts seen before 2020. However, the dollar value is prone to skew by outliers, which was especially noticeable in 2022 when Elon Musk accounted for nearly a third of the selling total by value.

Looking past that, the number of unique buy and sale transactions aligns with the flow of unique buyers and sellers. Lastly, we note that 10b5-1 selling participation remained elevated at 58% in 2022. The percent of sales executed by 10b5-1 plans has steadily climbed since 2004, when just ~30% of sales were executed via 10b5-1 plans.

Annual Buying & Selling Figures

| No. Buyers | No. Sellers | Value of Buys ($M) | Value of Sales ($M) | % Sales via 10b5-1 | |

|---|---|---|---|---|---|

| 2015 | 6,099 | 11,728 | $6,554 | $57,292 | 50.60% |

| 2016 | 5,038 | 11,228 | $6,821 | $59,635 | 44.50% |

| 2017 | 4,514 | 12,082 | $4,051 | $76,098 | 48.30% |

| 2018 | 5,254 | 11,007 | $6,061 | $74,684 | 53.10% |

| 2019 | 5,087 | 10,386 | $5,514 | $68,695 | 54.70% |

| 2020 | 6,562 | 10,342 | $7,946 | $100,798 | 60.10% |

| 2021 | 4,578 | 12,600 | $7,402 | $167,269 | 60.40% |

| 2022 | 4,803 | 7,675 | $6,776 | $61,960 | 58.20% |

| Source: VerityData | |||||

December 2022 Highlights

Roughly 700 insiders bought shares of their companies in December, a 7.7% increase over the number of buyers in the last month of Q3’22 but fewer than the approximately 900 insiders who bought in December 2021. The ~750 unique non-10b5-1 sellers in December 2022 was solidly above the ~440 in September 2022 but below the nearly 850 who sold in December 2021.

Taken together, the ratio of sellers to buyers ended up at 1.09:1, below the average ratio of monthly sellers to buyers at ~1.58:1.

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

The number of 10b5-1 sellers by month over the last five years. Source: VerityData

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

Horizon Therapeutics (HZNP) – Our Cessation of Selling event generated at HZNP on November 18 and we issued research on the unusual lack of insider selling at HZNP on November 21. On November 29, it was announced that three large pharmaceutical firms were interested in buying HZNP. On December 12, it was announced that Amgen (AMGN) will buy HZNP for $116.50 per share. The sequence of events was a reminder that sometimes an unusual lack of insider selling can precede material corporate events, including M&A. (11/21/22)

Tesla (TSLA) — Following sales of nearly $4.0B in shares at ~$208.60 in early November, CEO Elon Musk disclosed in mid-December that he’d sold another $3.6B in shares of the electric vehicle maker at $162.81. Our last two Research Briefs covering Musk’s sales have included this bit of commentary: “Musk has portrayed his sales over the past year as being for fairly benign purposes (taxes, paying for Twitter, etc.) not associated with TSLA’s stock price, the company’s performance, or the company’s prospects. But … Musk’s sales have been well-timed (and his buying in earlier periods was as well), so regardless of his reasoning for selling TSLA shares right now, it’s hard to ignore the expert timing of his previous sales.” (12/15/22)

NRG Energy (NRG) — The CEO, chairman, and four others from the board bought a combined $1.5M in shares at an average of $31.75. The six buyers were the most in a single quarter at the firm since Q4’15. The unusual buying happened amid the stock’s recent pullback, the market’s response to a proposed acquisition of Vivint Smart Home (VVNT). Purchases by CEO Mauricio Gutierrez, Chairman Lawrence Coben, and others suggest they believe the selloff was an overreaction (12/19/22).

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

Since January 1, 2004, all insider transactions at companies governed by the S.E.C.’s Section 16 regulation that requires disclosure of buys, sales and other transactions via Form 4s. Excludes 10% Owners (e.g. institutional investors and other non-management insider filers). An insider who buys/sells during the course of the year is only counted once for unique buyers/sellers counts.

For access, request a free trial of VerityData >>

For data inquiries relevant to this report, contact Ben Silverman.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo