Q2 2023 Insider Equity Gifts: Trend Report

Analysis from VerityData examining Q2 2023 insider equity gifts trends at U.S. companies.

In this article, featuring highlights of an Insider Equity Gifts Trend Report from VerityData | InsiderScore, we examine quarterly gift data and identify market, index, and sector trends related to insider equity gifts. Note: This article is an excerpt of an exclusive report for VerityData | InsiderScore customers.

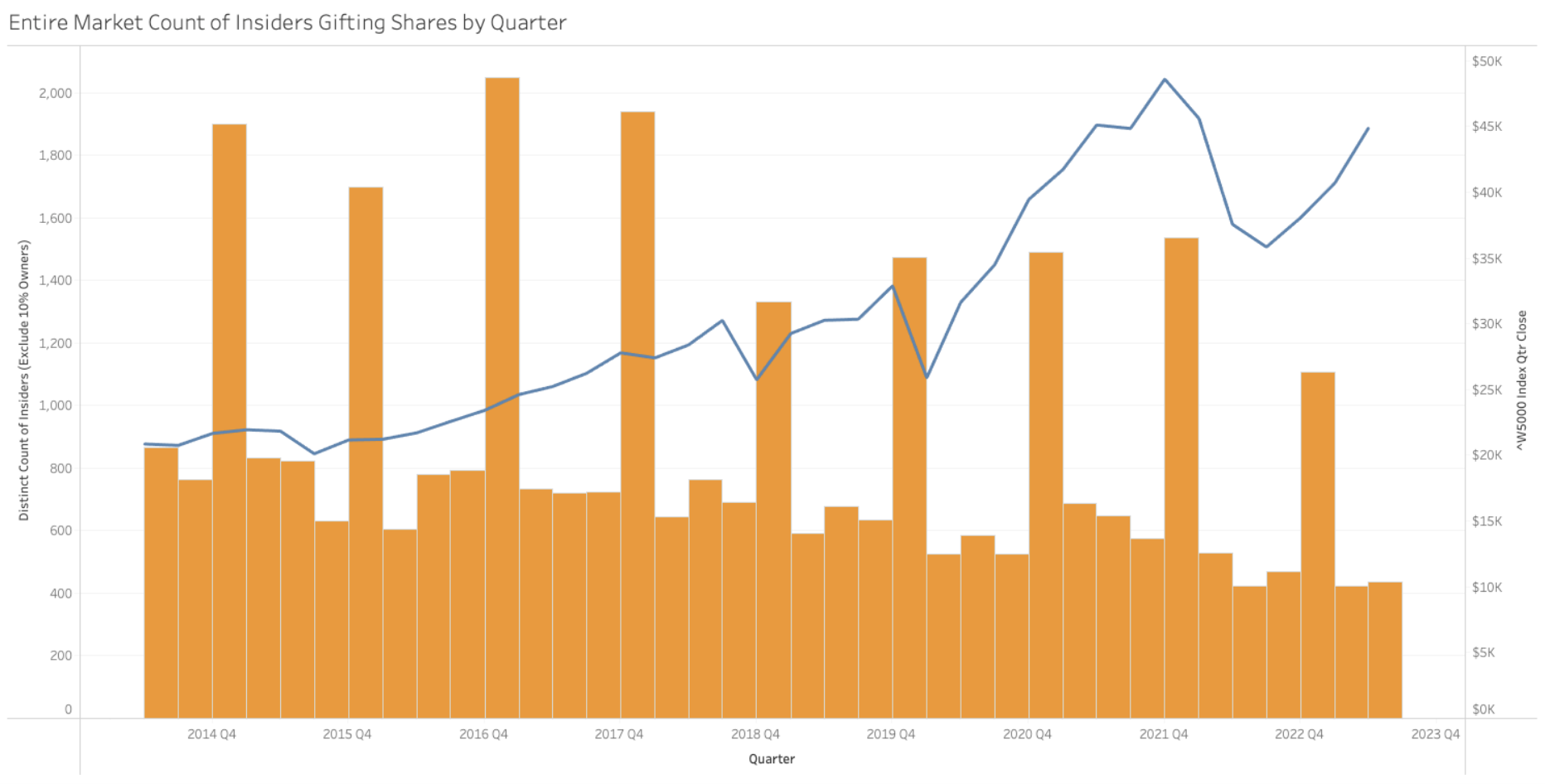

437 Insiders Gifted Stock in Q2’23; First YoY Increase in Five Quarters

A total of 437 insiders disposed of shares via gifts in Q2’23, up 3.3% from the same quarter year earlier. 2022 was a down year for gift-giving as the breadth of insiders was down each quarter YoY through Q1’23 until reversing in the latest quarter amid stronger equity prices. Gift-giving is highly seasonal and guided by market conditions. Insiders are opportunistic with gift giving and have been found to be unusually timely, a reason investors should track gifting.

Value of Gifts Increased 12% in Q2’23

Insiders gave $6.5B worth of stock in Q2’23, up 11.8% from the $5.8B gifted in Q2’22. Unlike the count of unique insiders who give stock each quarter, the value of gifts can be driven by outliers. In Q2’23, CEO Warren Buffett accounted for the majority of the dollar volume with his $4.6B gift.

Gift Breadth by Index & Sector (Disposition Only)

| Q4 ‘21 | Q1 ‘22 | Q2 ‘22 | Q3 ‘22 | Q4‘22 | QoQ Change | YoY Change | |

|---|---|---|---|---|---|---|---|

| All U.S. Companies | 423 | 468 | 1107 | 422 | 437 | 4% | 3% |

| S&P 500 | 124 | 126 | 336 | 130 | 128 | -2% | 3% |

| Russell 2000 | 152 | 179 | 457 | 159 | 174 | 9% | 14% |

| Technology | 63 | 76 | 164 | 53 | 84 | 58% | 33% |

| Financials | 96 | 107 | 309 | 98 | 74 | -24% | -23% |

| Healthcare | 61 | 61 | 135 | 55 | 69 | 25% | 13% |

| Industrial Goods | 56 | 75 | 142 | 76 | 69 | -9% | 23% |

| Consumer Discretionary | 56 | 62 | 143 | 59 | 62 | 5% | 11% |

| Consumer Staples | 25 | 17 | 52 | 18 | 19 | 6% | -24% |

| Real Estate | 31 | 21 | 40 | 15 | 19 | 27% | -39% |

| Materials | 11 | 20 | 31 | 20 | 17 | -15% | 55% |

| Energy | 14 | 19 | 71 | 19 | 12 | -37% | -14% |

| Utilities | 10 | 8 | 15 | 7 | 10 | 43% | 0% |

| Telecommunications | 1 | 2 | 9 | 3 | 2 | -33% | 100% |

Source: VerityData

Gift Giving Picks Up in Tech, Industrial Goods

The increase in breadth was driven by Technology and Industrial Goods that increased by 21 insiders (33%) and 13 (23%). Four other sectors also increased YoY with the percentage in the Materials sector largest at 55%. Decreases in breadth in Financial and Real Estate sector offset total.

The number of insiders gifting shares decreased by 22 in the Financial sector and was lower by 12 in the Real Estate sector. The percentage drop of -39% in the Real Estate sector was the highest market-wide. Financial and Technology sectors drove overall dollar value higher. The market-wide total dollar value of disposition gifts increased by $687M YoY (12%). The largest dollar value jump was in the Technology sector where there was a $426M jump (60%). Financial was in second place on a dollar basis with a $290M (7%) increase YoY. The small Telecommunications sector had the largest percentage jump.

Top 5 Most Timely Gift Givers of Q1’23

The following table looks back at the most timely gift givers of Q1’23 using the average gift price against the closing price from July 20. Gifts under $10K in value are excluded.

| Gift Amount | Average PPS | % Chg to Current Price | ||||

|---|---|---|---|---|---|---|

| David Michery | CEO | MULN | Mullen Automotive | $1,589,000 | $7.95 | -98.3% |

| Thane Wettig | Officer | FGEN | Fibrogen Inc | $26,700 | $19.91 | -89.5% |

| Kenneth H. Dichter | CEO | UP | Wheels Up Experience | $3,700,400 | $12.93 | -82.7% |

| JCIC Sponsor LLC | Director | BAER | Bridger Aerospace | $18,007,200 | $9.84 | -42.1% |

| Douglas Valenti | CEO | QNST | QuinStreet | $108,500 | $15.51 | -41.4% |

Returns as of July 24, 2023 close. Source: VerityData

About Insider Equity Gifts

Gifts can be opportunistic

Insiders opportunistically time gifts into stock strengths, according to academic research published in 2021 by professors at the University of Michigan. The authors of study found that “stock prices rise abnormally about 6% during the one-year period before the gift date and they fall abnormally by about 4% during the one year after the gift date, meaning that large shareholders tend to find the perfect day on which to give.” Earlier academic research focused on CEOs and chairpersons similarly showed gifts ahead of downside in shares.

Disclosure rules for gifts changed in April 2023

Gifts are now required to be disclosed within two business days on form 4s, compared to the previous rule that allowed insiders to report gifts up to 14 months after a gift. The SEC rule amendment was reviewed in Verity’s March 2023 blog post. VerityData splits disposition and neutral gifts.

Insiders use gifts to move shares in various ways

Disposition gifts are situations in which the shares are no longer reported by the insider, which may include their own foundations or third-party charities. Neutral gifts have no impact on the insider’s total ownership and are often going from one bucket of ownership to another (such as direct ownership to a trust they continue to report).

Is It Time to Upgrade Your Insider Intel?

Generate differentiated ideas and manage risk with access to regular research reports and powerful insider data & analytics from VerityData | InsiderScore.