Considering an RMS? How to Overcome Stakeholder Bias for Status Quo

Get concepts for empowering stakeholders to arrive at a decision regarding a modern research management system.

Front-office investment teams need norms. The world around us is in constant flux and the status quo — routines and processes — can provide a feeling of stability. But the status quo is not always a positive.

A landmark meta-analysis of psychological research “Status Quo Bias in Decision Making” investigated how “status quo framing”—that is, making one option the default choice — affected decision-making. The authors found that, when given a variety of options to solve a problem, people tended to choose whatever is framed as the default — and not whether it is objectively the best.

In the spirit of helping leaders and/or changemakers avoid lost time and effort, here are some concepts and principles for facilitating change beyond the status quo bias.

[Related: Jumping from Shared Drives to Modern RMS: The Sixteenth Street Capital Story]

How to Help Stakeholders See Status Quo Bias

Status quo bias is closely related to loss aversion — the idea that people focus more on what they believe they could lose from a decision than what they stand to gain. Since deviating from the norm feels risky, we often stick to inaction.

When considering an RMS, it’s helpful to think about the risks and costs of staying with the current solution — and to do so from the perspective of the different roles involved in the decision.

Portfolio Manager Bias

“Our process isn’t perfect, but it works right now. I don’t want to disrupt it.”

If a process is generating returns, some PMs balk at any change to it. Any good RMS provider will appreciate this concern. It’s why we’ve developed an implementation process and model that absolutely minimizes any process change to the team using it.

How a Modern RMS Adds Value

Without the status quo concern for a disruption, PMs can consider a modern RMS for the value it can add.

More portfolio visibility/insights. Real-time, automated dashboards and alerts can keep PMs on top of more of the portfolio.

Smaller losses from staff turnover. With a modern RMS, all the team’s knowledge is retained in one place. Losses are smaller. Onboarding new analysts is much faster.

Workflow best practices. Are there dashboards or processes that other firms have found useful? The VerityRMS customer success team knows what works — and what doesn’t.

Qualitative & quantitive views. See the latest data (market, 3rd party) right next to your team’s qualitative research & analysis.

Timing is everything. Confidence is essential. For a portfolio manager, a modern RMS keeps them always updated.

Analyst Bias

“I don’t want to think about another tool to use. I want to think about my actual work. In fact, I want fewer destinations.”

It’s useful to think of an RMS not as another tool, in an additive sense, but as an integrated workspace that brings the most valuable parts of what you’re doing into one place. So you can do your best work and articulate it as intelligently and concretely as possible to a PM.

In truth, an analyst who wants to keep using OneNote, Word, and Outlook in the way they currently do, can still retain their process and benefit from the RMS.

How an RMS Adds Value

Once you set that status quo objection aside, analysts appreciate a modern RMS because it lets them:

- Manage models, ideas, and data without duplicate work.

- Search all the team’s content instantly.

- Make use of GenAI to improve productivity.

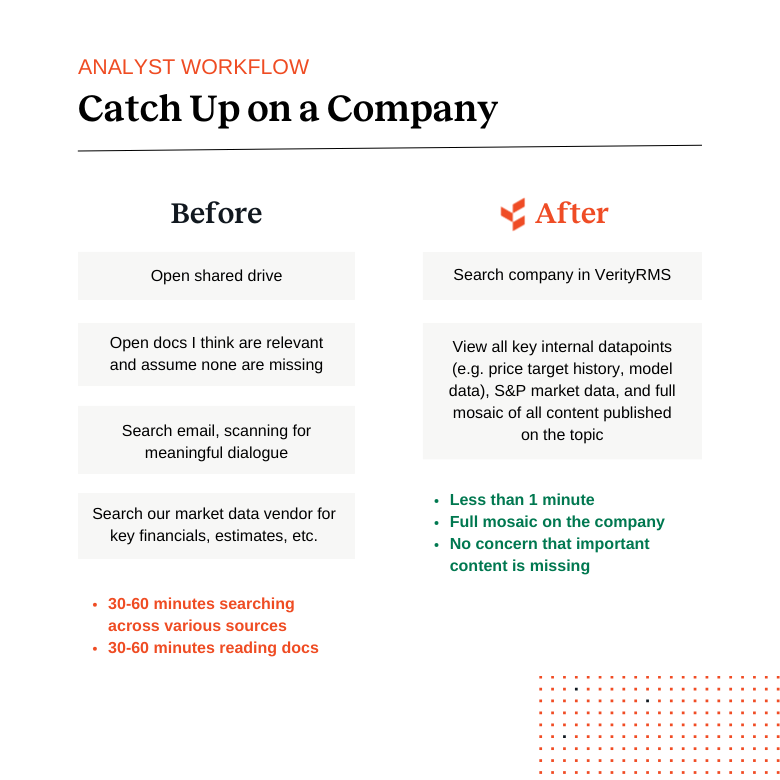

More focus. Fewer places to search. Getting caught up goes quickly with a modern RMS — whether an analyst is new to the team or picking up a new name.

CTO/CIO Bias

“We already manage a lot of tech that seems to do what an RMS does. Besides, another vendor comes with more risks.”

Perhaps you don’t have a CTO or CIO, but someone at your firm does the work of one. Either way, introducing an RMS can seem like an extra layer to squeeze into an already-dense tech stack.

Analysts and PMs certainly are overloaded with apps. The problem is that the apps, even when used properly, require teams to hop in and out of them. Aside from the inefficiency that causes, the different apps create information silos of their own.

How a Modern RMS Adds Value

But the reality is that a modern RMS fulfills duties no other software does and also reduces risk by securing the firm’s IP.

Control & security. Would you like to have more control over how users download the firm’s IP?

GenAI enhancements. Would you like a vendor to help you empower research teams to use generative AI?

One source of truth. Would you like one platform and source of truth to fully integrate with your tech and system stack?

General Bias

“Now is just not the time to make the switch to an RMS.”

The last status quo objection we’ll cover is timing. Migrating content to the RMS, configuring the system to your team’s workflow, and adopting the technology can seem like a long and heavy lift. But, for VerityRMS customers, it’s not.

- Painless migration: Typically, 4-6 weeks. Streamlined processes from our veteran team ensure a smooth transition.

- Quick configuration: Your dedicated customer success gets your system configured to your needs. The no-code toolkit lets you customize on the fly.

For Sixteenth Street Capital, the investment team was quickly up and running with their new research management system. Verity migrated all historical data — from email and their shared drive — in less than a month. New users were logging in to VerityRMS within a week after the contract was stamped.

Bottom Line

For investment teams, breaking free from the status quo and discovering the advantage of untapped possibilities is what they do best. A modern research management system is in perfect alignment with that spirit. The team can waste less time on mundane tasks, better engage with the firm’s intellectual property, and act confidently on the best ideas in the portfolio.

Have Questions About Updating to a Modern RMS?

Let’s talk. At Verity, we’ve helped hundreds of funds of all sizes transform their investment research process to improved productivity, visibility, and speed to insights.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo