Looking to Raise More AUM? How Investment Managers Tout Their Differentiated Process to Investors

Learn how firms can share, execute, and defend the story of their process with a dedicated investment research management system.

For startup firms or firms looking to scale, a solid investment story — whether in the shape of a pitch book or RFP response — can go a long way in demonstrating your consistent ability to outperform peers.

Look at any RFP issued from asset allocators and you’ll find more than a handful of questions — sometimes entire sections — dedicated to understanding your firm’s investment process.

For example:

- Describe how your approach differentiates your philosophy and process from your competitors.

- Describe and explain the overall investment process.

- How do portfolio managers process information from analysts?

- Detail efforts or decisions made on a team (or consensus) basis.

In this article, we’ll share a few ways that firms share, execute, and defend the story of their process, highlighting how you can do the same with a dedicated investment research management system (RMS).

How do you show that your investment process is repeatable? How do you show that your team is working together in ways that competing firms aren’t?

Related Content: Optimizing Hedge Fund Workflows for Operational Alpha

Defending Your Investment Process

Many investors ask you to share all the critical components of your investment approach – e.g., screening, sourcing, investment selection, and more. The ability to defend a repeatable process — that helps protect you and your clients from risk — is a clear-cut method to secure investor trust.

MINIMIZING RISK IN THE PORTFOLIO

Allocators will naturally be interested in understanding what processes you have in place to minimize risk from entering portfolio. With an RMS, PMs can set up alerts and automate workflows that put your team ahead of the curve rather than behind it.

You can quickly answer questions like:

- Is your model for Company X stale?

- Is it time to talk to the management team?

- Did analyst conviction or price targets change? And why?

An RMS allows you to track any number of questions through alerts that can be delivered to you either in the app, via email, or both.

PROCESSING INTEL FROM ANALYSTS

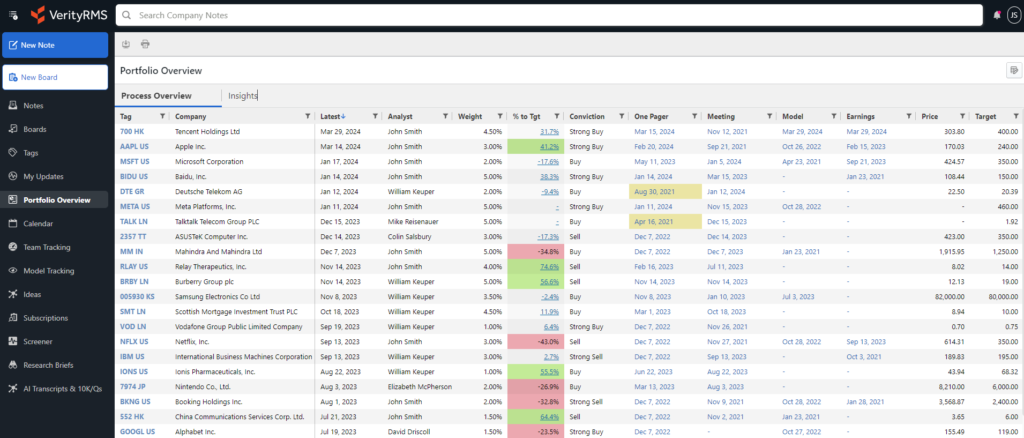

Many firms competing for assets will have an informal, email-based approach to how they digest research from the team. A portfolio overview dashboard, like below, combines your team’s research output alongside market and/or third party data (such as data from your portfolio management software). By bringing them into one screen, you have a differentiated view into your firm’s outlook.

A portfolio overview dashboard can offer one differentiated view that combines your team’s data with data from the market and/or third-parties.

WATCH: How Investment Managers Use VerityRMS for Portfolio Monitoring

FOSTERING TEAM COLLABORATION

Investors are interested in hearing about how your team approaches proprietary research and collaboration. Examples of how you and your team come up with productive investment ideas go a long way.

- How do PMs collaborate with analysts?

- How do PMs digest the research created by the analyst team?

Remote or hybrid work has changed how teams work together. Walking over to an analyst is not always feasible. You may be halfway across the country from certain team members. Investment teams use a modern research management system to stay connected to their work and each other — regardless of where you’re located.

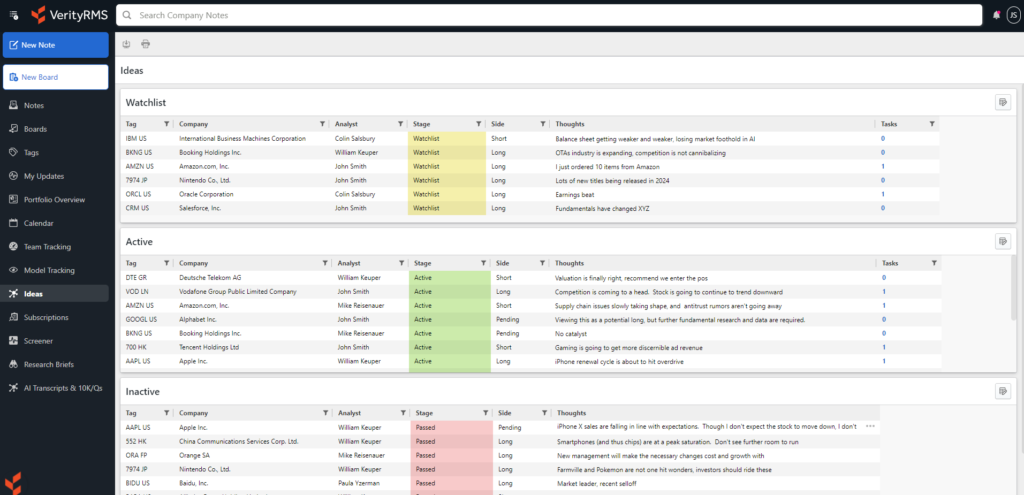

SELECTING & TRACKING NEW IDEAS

What ideas are being worked? Where is analyst conviction? Other ideas? One of the ways teams use VerityRMS to put their process into practice is to create a dashboard that aggregates new ideas and organizes them by any number of criteria — enhancing the idea gen process.

For example, you might include a column signifying the stage of an idea so that you quickly understand the status of all the new ideas in your pipeline and where they fit, so your team is always tracking toward progress. Keep in mind any data you gather can be later translated into a report.

Bottom Line

A clearly articulated investment process (that is defendable with real-life examples) is a key element to gaining investor trust and growing your portfolio size. Investors want to know that what you’re building is repeatable and differentiated.

See How Top Firms Solidify Their Process With VerityRMS

At Verity, we offer the modern research management system trusted by global asset managers. Request your custom demo to explore the possibilities VerityRMS can bring to your process, workflows, and decision-making.