-

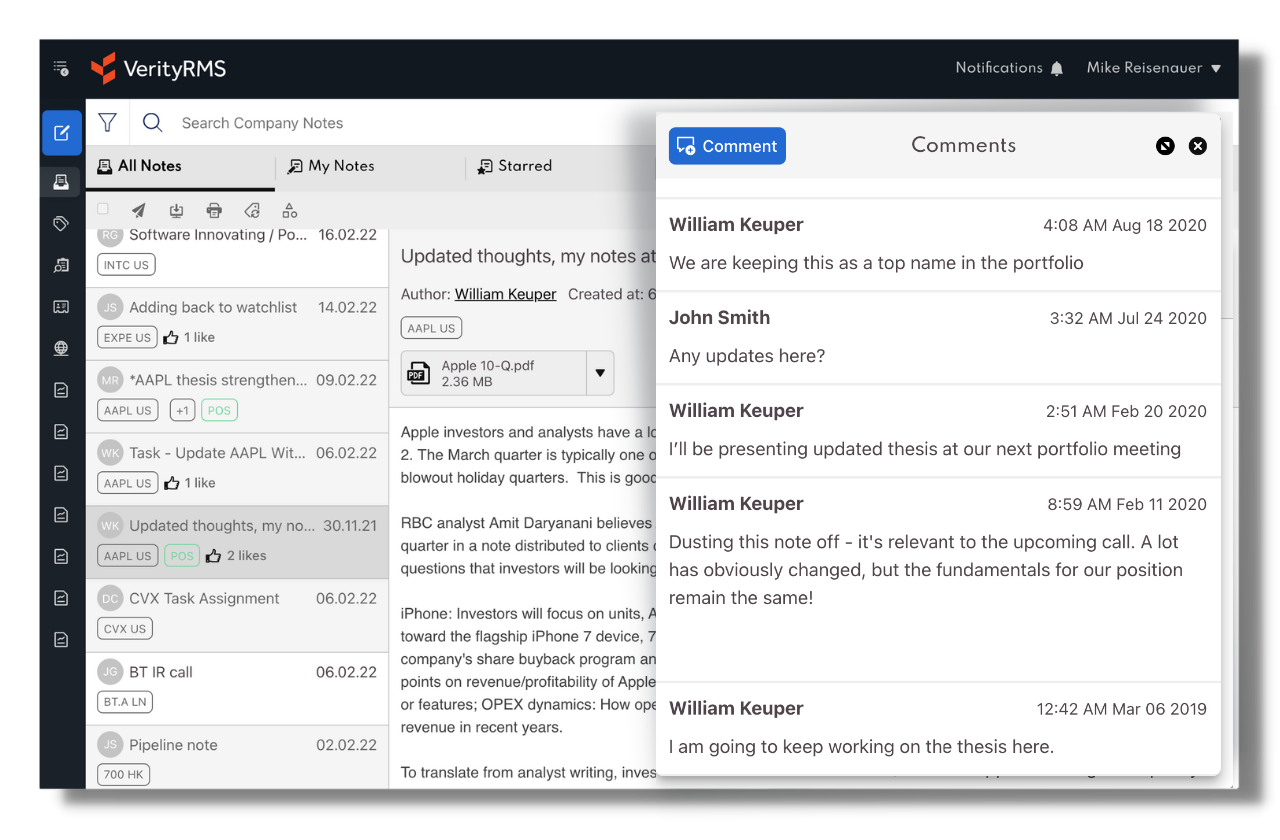

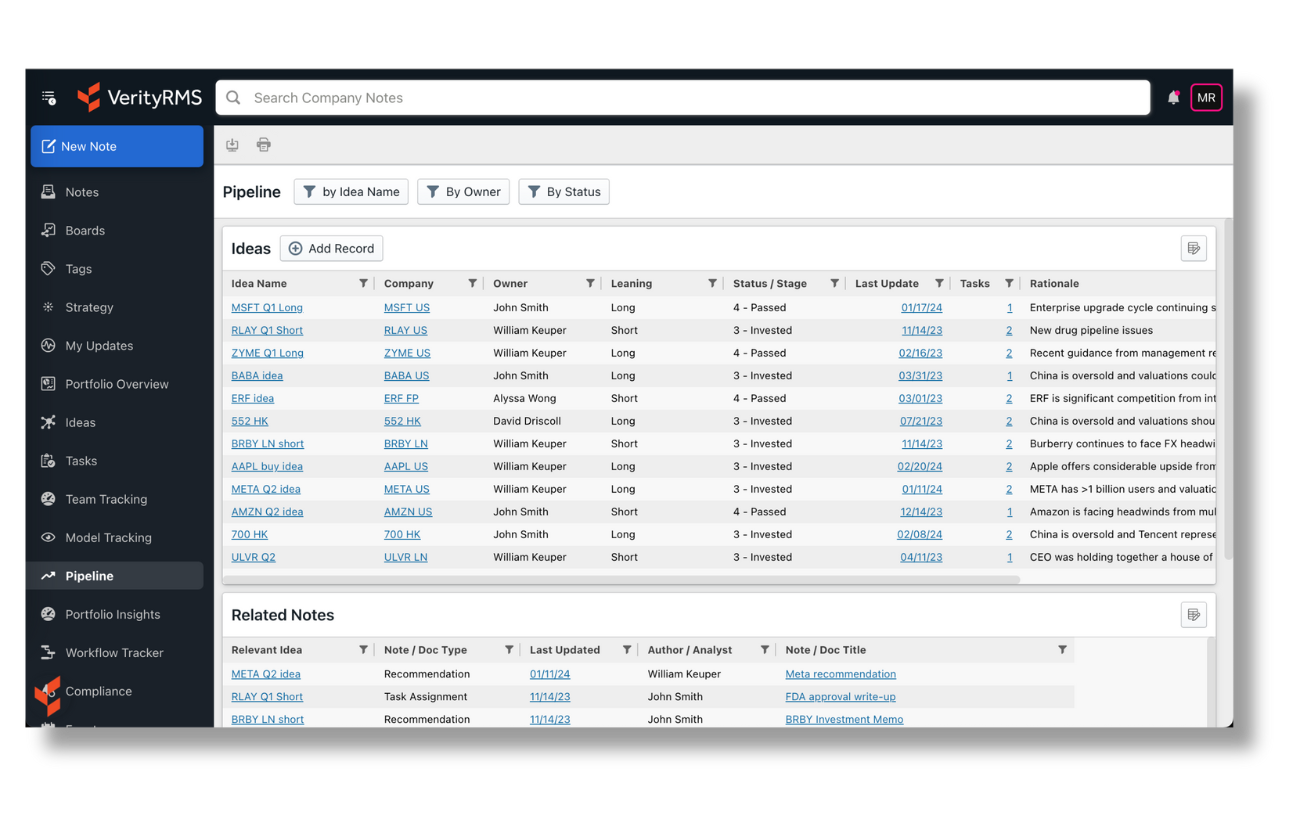

Get real-time alerts & clear visibility into the insights that drive decisions.

-

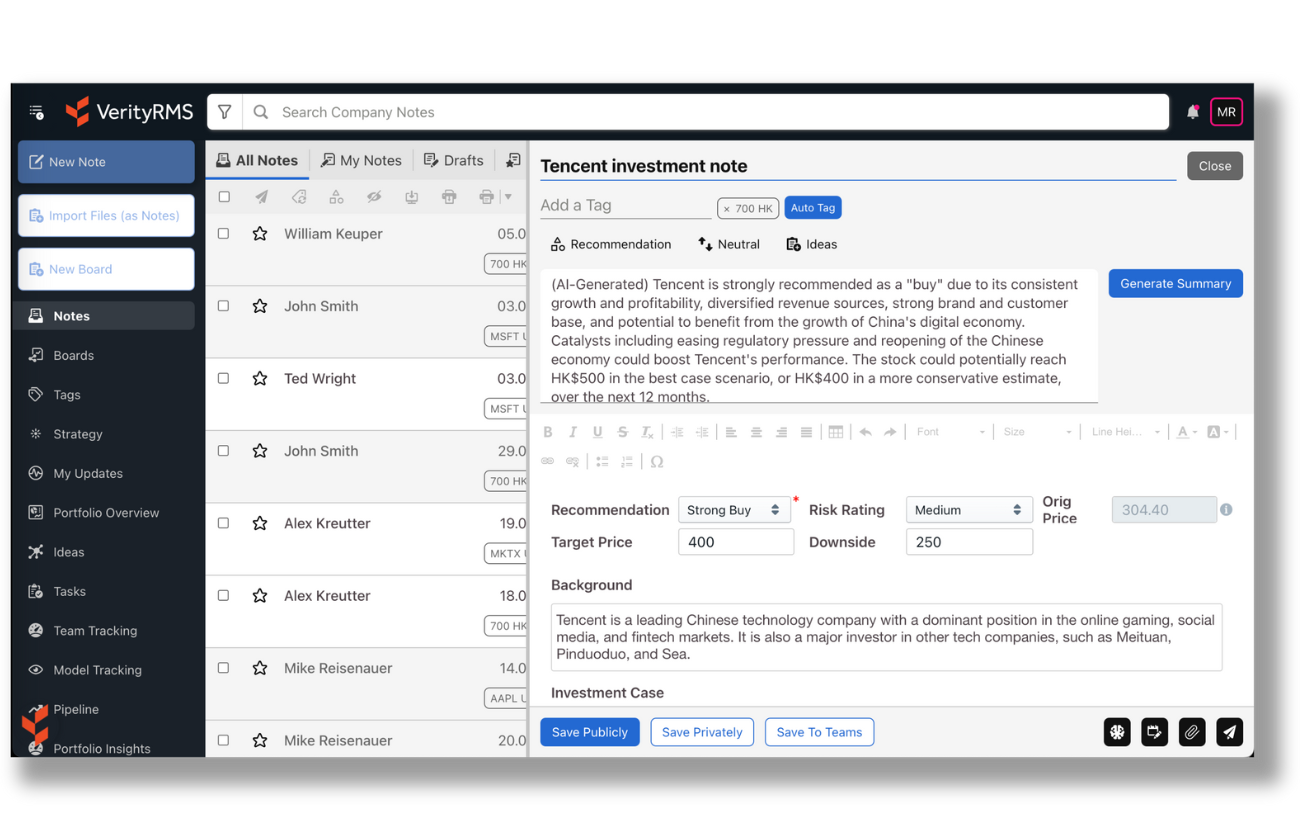

Use AI to elevate intel across your firm's proprietary research.

-

Aggregate data from multiple sources for the context you need.

There's no alpha in busywork. Make success automatic with investment research management software that improves efficiency, knowledge sharing, & decision-making at scale.

-

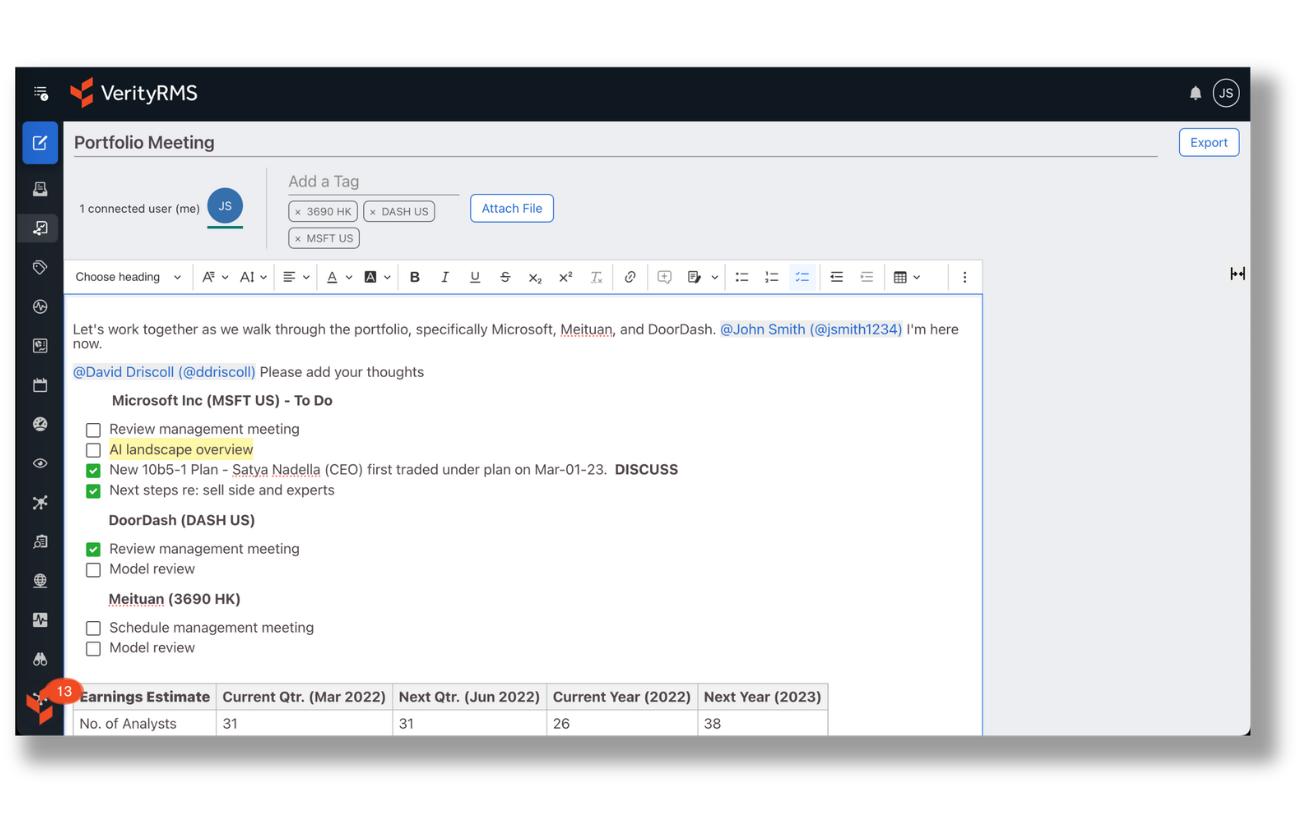

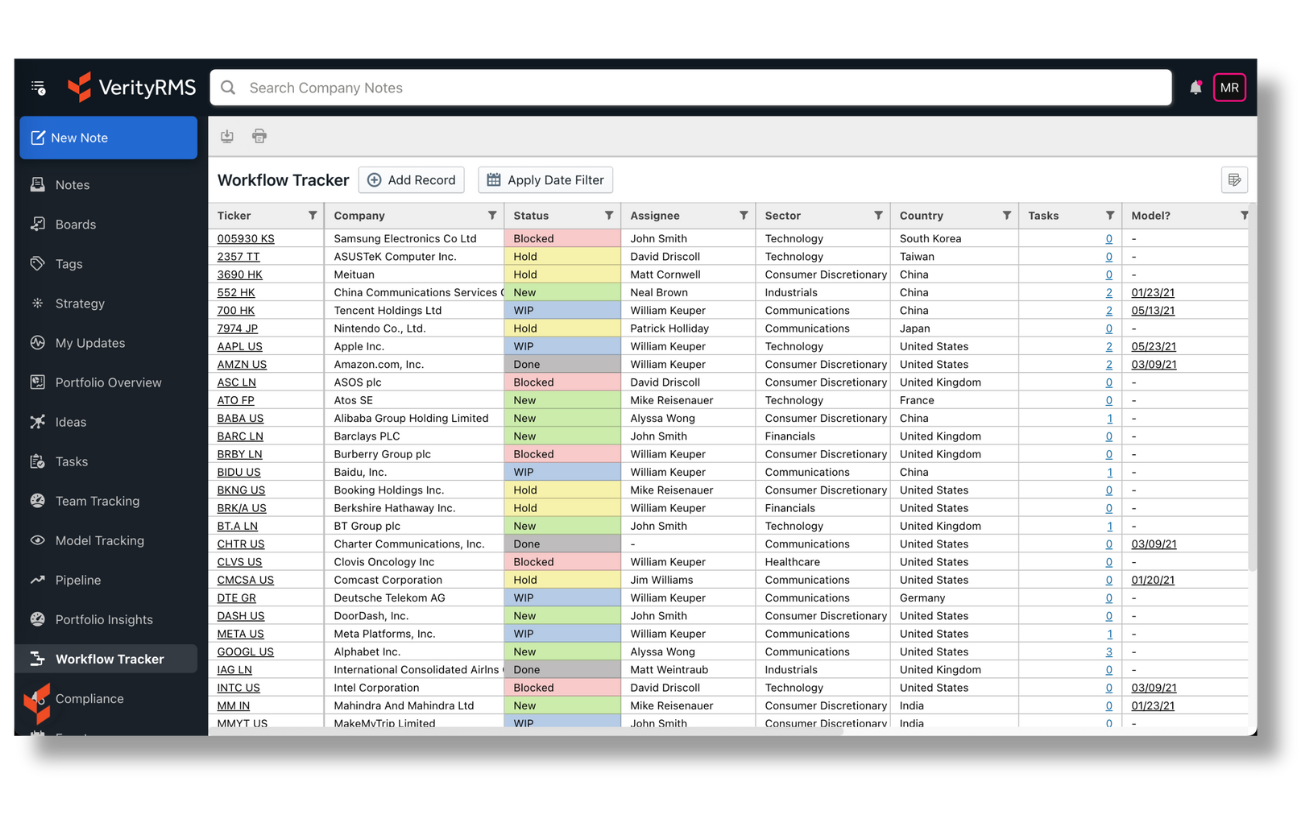

Automate time-consuming manual processes.

-

Use productivity tools designed for your team. Boosted by AI.

-

Connect your talent to knowledge, tools, & data they need.

-

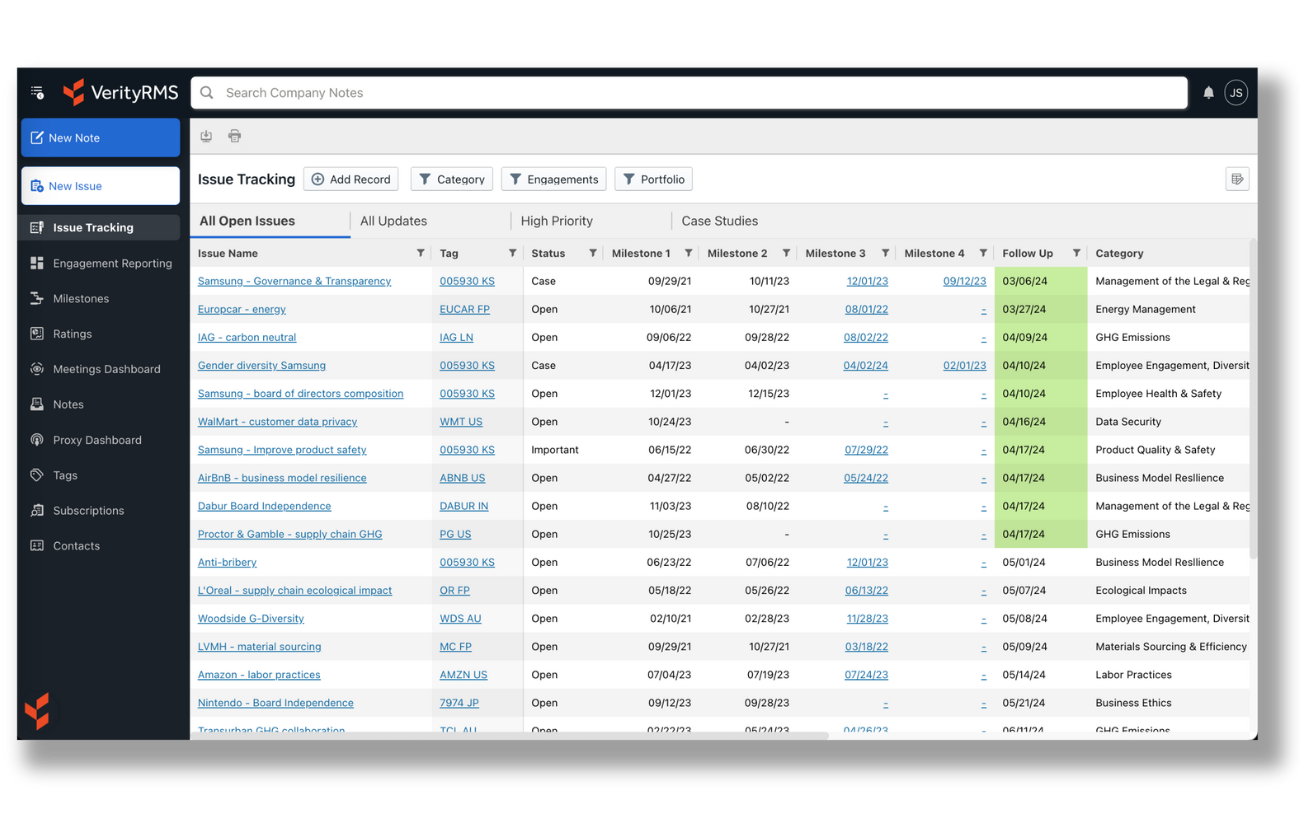

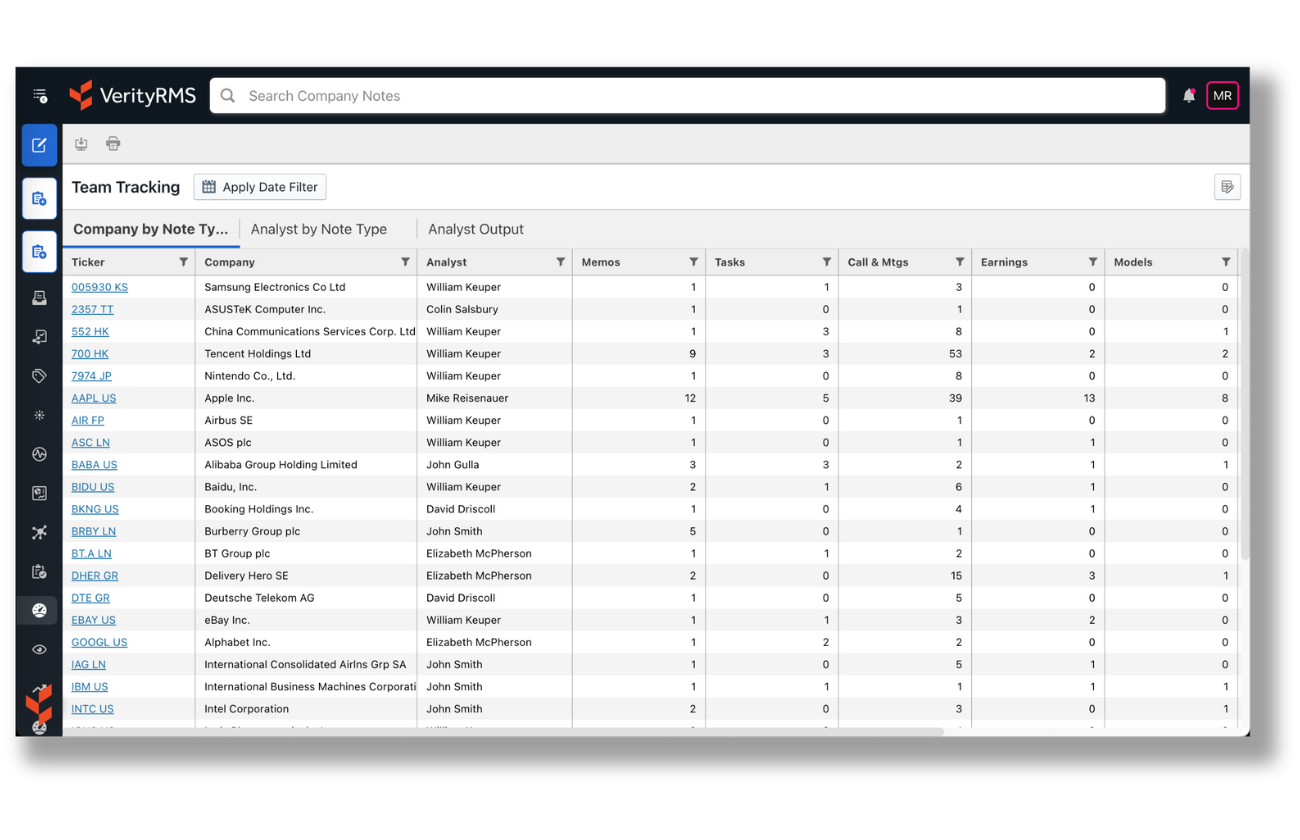

Improve transparency for fast, frictionless reporting.

“We looked for investment research management software that brought high-caliber organizational capability to our investment research workflows. We found it with VerityRMS. Both the technology and the team at Verity have been a great match for us: fast, professional, and easy to work with.”

Director, Sixteenth Street Capital

Why Real Firms Choose VerityRMS

Frequently Asked Questions

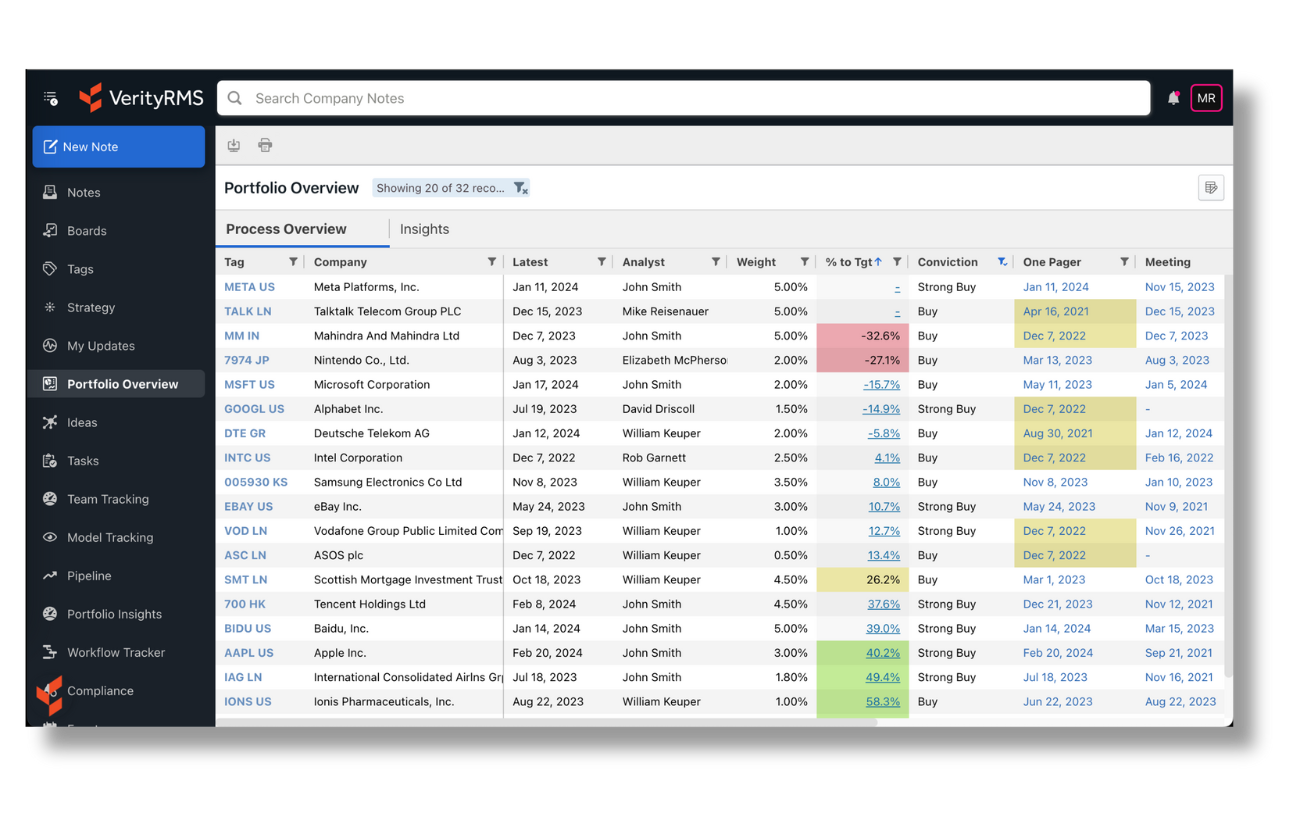

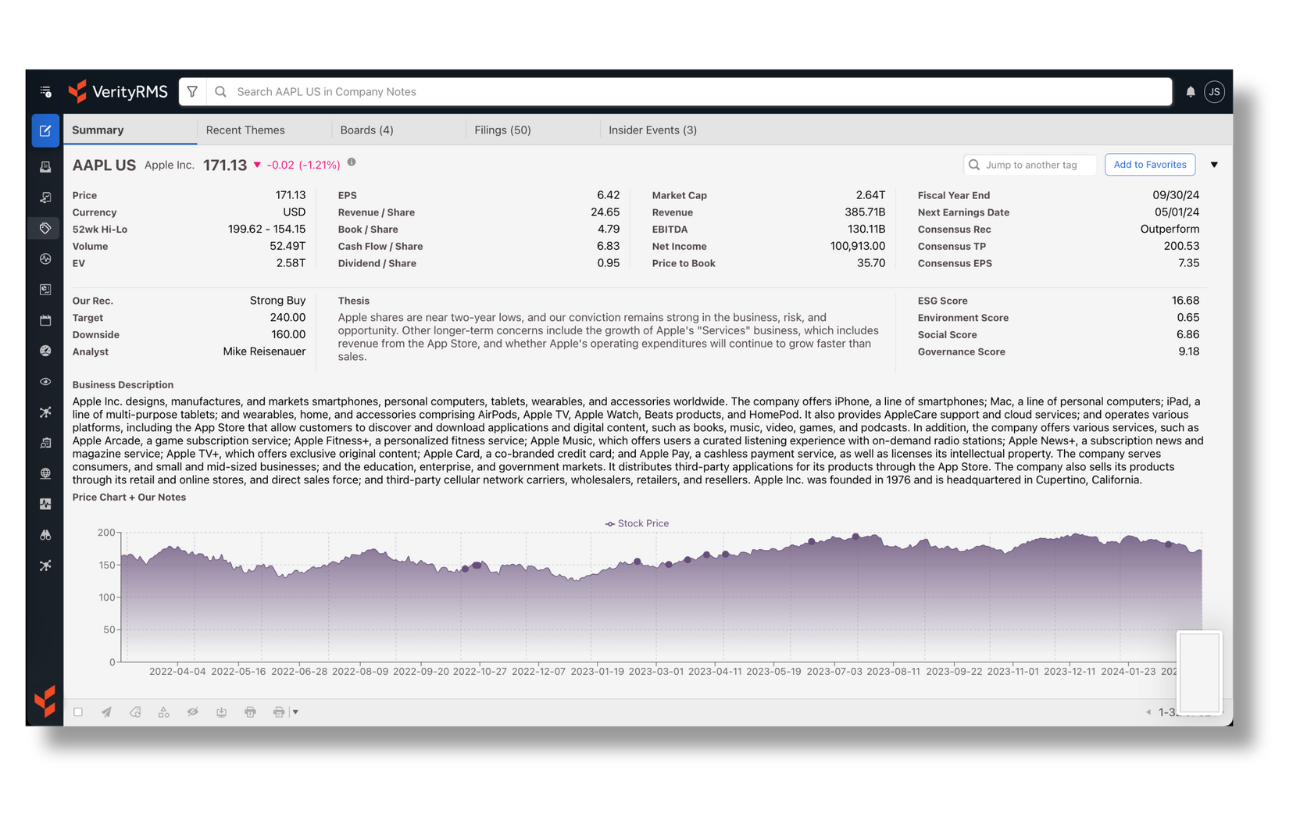

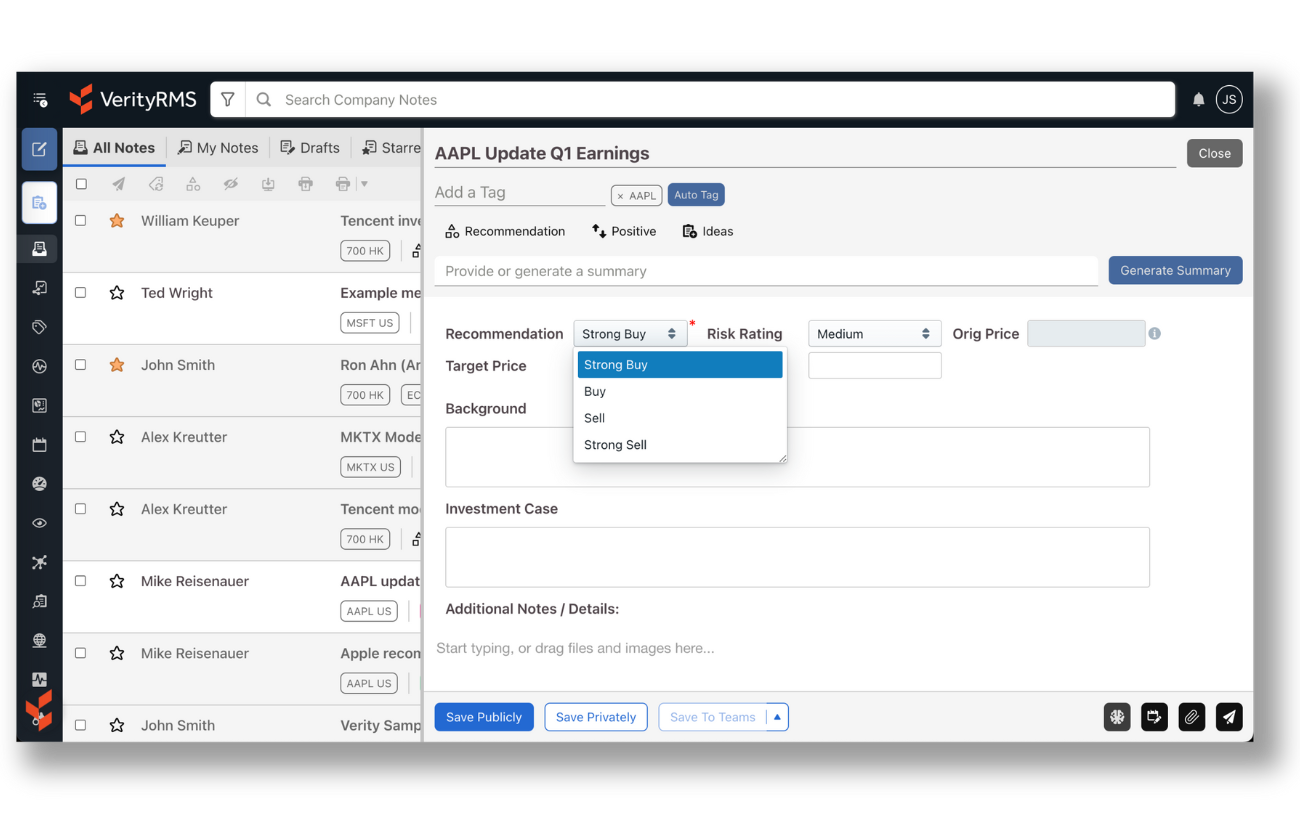

VerityRMS is investment research management software that helps investment teams capture, share, and act on the full body of their firm’s investment research and data. Analysts can easily record their thinking & ideas, portfolio managers get all the context they need to make decisions, and compliance has a clear record of the process. By making research easier to access and connect across the team, VerityRMS helps firms turn individual notes, memos, and models into collective knowledge — leading to sharper investment decisions.

VerityRMS makes research easier to connect, recall, and act on. Analysts can build on each other’s work instead of starting from scratch, portfolio managers can see the full history behind an idea before making a call, and compliance can access everything without slowing the team down. With tools for dashboards & alerts, automated workflows, knowledge sharing, and smart search, VerityRMS helps firms turn day-to-day research into a long-term advantage.

VerityRMS is used by a wide range of investment firms — from hedge funds to long-only asset managers to multi-manager platforms. Smaller firms value how quickly they can get started, while larger firms use it to coordinate research across multiple teams, regions, and strategies. The system supports equity, credit, and specialized workflows like fixed income research and stewardship reporting. That flexibility allows different groups — from analysts to portfolio managers to fixed income teams — to work in one connected system without losing the nuances of their process.

Yes. VerityRMS connects with the systems investment teams rely on every day. It integrates with productivity tools (like Outlook, Teams, and Excel), portfolio management systems such as Enfusion, and market data providers like Bloomberg. For firms with custom or proprietary platforms, VerityRMS also offers a flexible API to extend integrations even further. You can see a list of supported integrations here.

Absolutely. VerityRMS keeps investment research safe using security practices trusted across the industry, and it’s SOC 2 certified. The system keeps complete, time-stamped records of research activity, making audit reports easy to run. And with access controls in place, only the right people can see the right information.

Most firms are up and running in just a few weeks. The Verity team works with you to configure the system around your research process, move over important content, and train your team. The goal is to get analysts and PMs using VerityRMS quickly without interrupting day-to-day investment work.

Many firms look at VerityRMS after trying or evaluating other systems. Tools like AlphaSense focus mainly on external content, while Bloomberg and FactSet offer RMS as add-ons to their terminals. Bipsync emphasizes configurability but is built as much for LP/GP investors as for direct investors. By contrast, VerityRMS is focused on fundamental investment teams and is flexible enough to support equities, credit, stewardship, and multi-manager workflows.

One thing that sets VerityRMS apart is its balance of configurability and adoption: firms can tailor workflows, reporting, and permissions to their process without being locked into rigid templates. It’s vendor-agnostic, so you can integrate the data and systems you already use, including your PMS/OMS. And because it’s SOC 2 certified and proven at scale with 100s of firms managing over trillions in assets, firms trust it for both security and longevity.

Yes. Native apps for iOS and Android work both online and offline, so analysts can capture and access research anywhere.

Verity products, including VerityRMS, are licensed by the number of users and typically billed annually. Pricing can fit smaller teams as well as large investment firms. To get a quote, we suggest requesting a demo so we can recommend the right package for your needs.

Yes. VerityRMS includes a No-Code Admin Toolkit that lets your team build custom dashboards, reports, and workflows without needing developers.

Yes. VerityRMS includes optional AI features that help investment teams save time and get more value from their research. Analysts can have notes automatically summarized, tagged with tickers, or have key fields like target prices pulled into templates. Portfolio managers can use AI Chat to query their firm’s research directly, with cited answers that point back to the original source material.

We see AI as a way to eliminate repetitive steps and make insights easier to find — not to replace human judgment. All features are configurable, and firms can choose to run them through Verity’s managed environment or their own AI instance, ensuring security and compliance.

Experience the Power of Modern Investment Research Management Software

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Get My Demo