The Insider Review | May 2022

A monthly summary of notable insider trading activities from Verity’s Director of Research.

In Brief

- Typically quiet April means big questions will be answered by insiders in May.

- Getting investment intelligence from insider equity grants.

- Talking insider selling by oil executives and 10b5-1 regulation changes.

Macro: Quiet April Sets Up a Potentially Loud May

Insider trading volume was low in April 2022 and that’s no surprise. The first month of each quarter is typically quiet because trading windows are closed at most companies ahead of earnings announcements. When stocks aren’t hitting new highs, as was the case last month, 10b5-1 selling is also depressed.

3 Things to Consider

With April in the rearview mirror, we look to May and the post-earnings environment and there’s some things we need to think about.

Will insiders move off the sidelines? Sell volume was depressed in Q1’22 (a good thing) but we didn’t see the rush of buyers we most often do when the market pulls back significantly (a bad thing). Insiders, thus, were as confused as other market participants about issues like inflation, supply chain challenges, and Russia’s invasion of Ukraine. Insiders have an advantage of other market participants — they get free or low cost-basis stock and blissfully sit on the sidelines racking up stock-based compensation and waiting to sell until the stock reaches a valuation they’re comfortable with. Another quarter of relative inactivity would send an uneasy message suggesting insiders don’t have a firm grasp on the headwinds impacting their businesses.

Will insiders buy? The CEOs of General Electric (GE), Intel (INTC) and Charles Schwab (SCHW), and the CFO of General Motors (GM) each bought shares in late April/early May. That’s a nice way to get buying activity going this quarter — four household names in four different industries — but we’ll need to see broad participation from insiders to get some confidence about underlying business conditions. The six-month Short-Swing period for insiders who sold in Q4’21 has or is expiring for many, so we’ll be looking closely to see if we get sentiment reversals with most stocks down meaningfully from Q4’21 valuations. If insiders don’t want to put cash in at current valuations that’s not a good message.

Will insiders sell? Insiders will make up for the aforementioned depressed selling volume in Q1’22 at some point and if that happens this quarter it’s going to send a negative message. Many insiders pushed off normal Q1 selling related to restricted stock vestings, holding out for higher prices, and showing admirable restraint. Insiders will get paid, however, so if they’re unwilling to wait for higher prices again this quarter the message will be a dim near-term view.

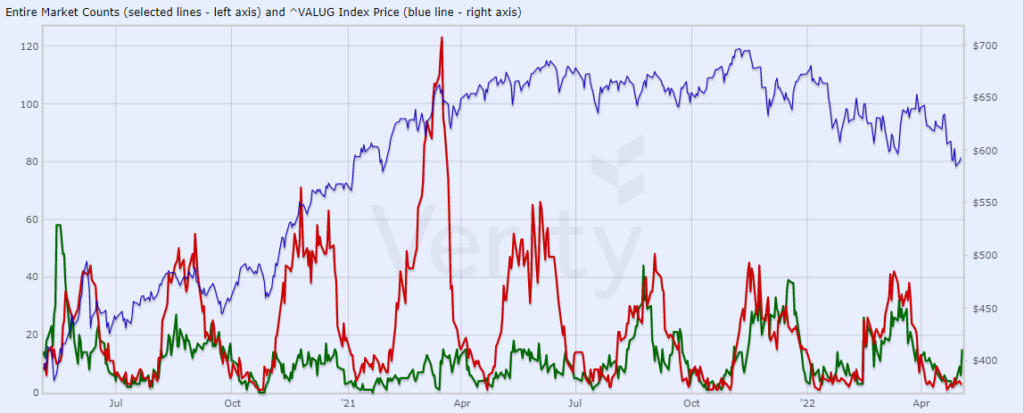

The chart display shows cluster buys (green) and cluster sales (red) over the past two years. Notice the dip in each at the beginning of every quarter, an indicator of typical seasonality.

Cluster buys (green) and cluster sales (red) over the past two years. Notice seasonal dips at the beginning of every quarter. Source: VerityData

Data Spotlight: Insider Equity Grants

Analyzing their buying and selling isn’t the only way to get valuation-related intelligence from insiders. VerityData recently launched an Equity Grants database that allows for the opportunity to identify unusual stock-based grants to insiders. Unusually-timed or constructed awards are often opportunistic in nature — a way for the board to reward executives while the stock is trading at what is perceived to be a low price.

Another subset of insider equity grants that provides valuation insight is those that are based on stock-price achievement. The assumption that EPS is a main factor guiding executive compensation is outdated (rTSR is more important) and we’re seeing more and more stock grants that are tied to the stock achieving a specific price.

Learn more about our Equity Grants database and how to generate investment ideas from the data in Senior Research Analyst C. Max Magee’s recent blog post.

Oil Insiders Took Advantage of Q1 Oil Price Boom; 10b5-1 Selling in Spotlight

Executives at oil companies sold more than $1.35 billion in shares in Q1’22 and the seller-to-buyer ratio hit a 10-year high. Bloomberg examined this in a recent article powered by data and analysis from VerityData. Meanwhile, Financial Times recently looked at the Securities and Exchange Commission’s attempt to crackdown on Rule 10b5-1 plan abuse. We provided the publication with examples of executives who sold via Rule 10b5-1 plans within days of adopting those plans, behavior the SEC is looking to eradicate.

About the Data

Data included in this report is sourced by VerityData’s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

For access, request a free trial of VerityData >>

For data inquiries relevant to this report, contact Ben Silverman.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo