Research Management Systems in 2026: Trends, Tools, & Buyer’s Guide

As margins shrink, fund managers are improving efficiency and driving costs down while making it easier to work and collaborate without boundaries.

The investment world has changed significantly in the 20 years since the first dedicated research management systems arrived. These then state-of-the-art systems gave fund managers a digital escape door from the manual, paper-based systems of the 20th century.

As many of these research management systems get consumed by strategic buyers and development of the product slows or stops, Verity is often engaged by investment teams to determine what modernization looks like.

In this article, we’ll share context and insights for investment teams that may be:

- Combining prosumer tools (Office docs, shared drives, Slack, etc.)

- Using a legacy desktop research management system.

- Using lightweight RMS systems often built into external doc search portals.

- Using an in-house system.

[WATCH: How Firms Reduce Decision Lag, Unburden Talent, & Scale Their Edge With VerityRMS]

What Is a Research Management System (RMS) in 2026?

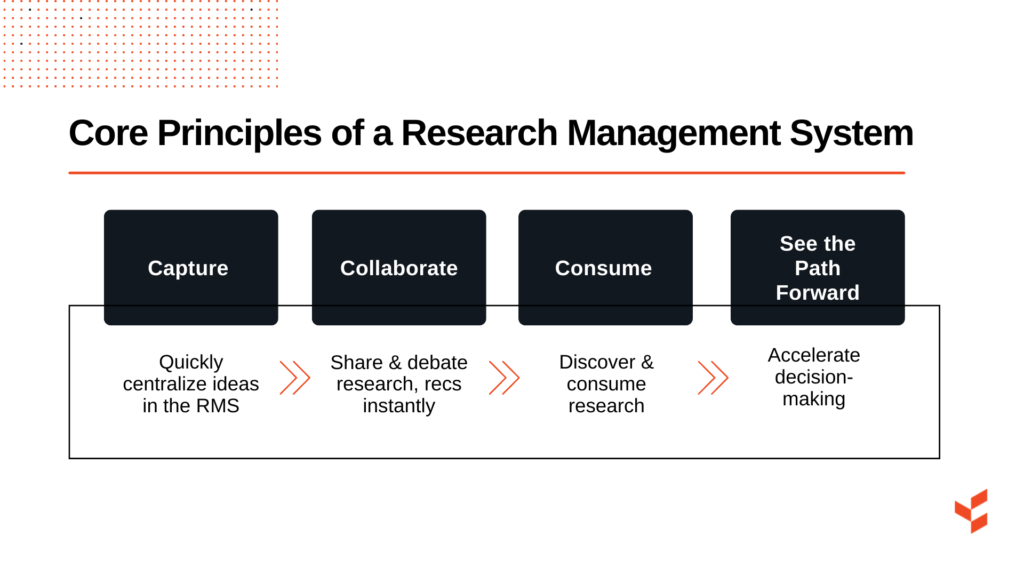

A research management system (RMS) is web-based software that helps institutional investors organize, manage, act on, and report on investment research.

An RMS provides an integrated workspace for analysts to create, share, and locate research and for portfolio managers to view and act on analyst research and recommendations. At the same time, an RMS gives middle and back-office teams control and security while making it much easier to generate reports.

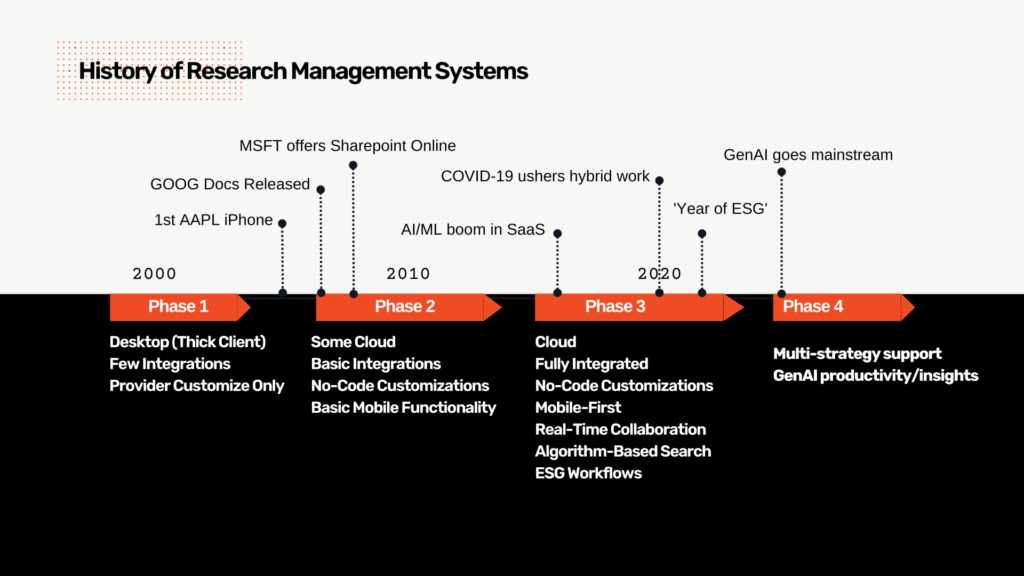

Timeline illustrating the evolution of Research Management Systems (RMS) from early desktop-based solutions to modern AI-driven platforms, highlighting key technological milestones and feature advancements across four distinct phases.

While the core function and purpose of an RMS has remained in many ways the same over the last few decades, the technology itself is continuously shaped by macro trends, tech innovations, and more. In the timeline above, you’ll notice the four phases of innovation have broadly influenced how we define success in the modern RMS landscape.

The investment world has changed significantly in the 20 years since the first dedicated research management systems arrived. These then state-of-the-art systems gave fund managers a digital escape door from the manual, paper-based systems of the 20th century. Then, as cloud-based tools like Microsoft Office, took hold, some firms opted for those tools, which were widely available to front office teams, but not designed with their needs and use cases in mind.

Meanwhile, modern research management systems have continued to evolve. Today, funds should expect their RMS to face the reality of hybrid working, mobile device proliferation, demands for ESG transparency, the explosion of apps and data used by research teams, and innovations in generative AI.

[Related: Weighing the Tradeoffs of Common Research Management Tools]

Why Funds Use Research Management Systems

In a term, operational alpha. Many asset managers turn to investment research management software to help streamline idea generation and research, standardize workflows, enhance compliance, and improve team collaboration. It brings clarity and focus.

Fear of Missing Important Developments

The extremes in your portfolio are easy to identify. The Market, CNBC, and Bloomberg all tell you the big movers. But staying on top of outliers that are slowly moving upward or downward? That requires process. A modern RMS bolsters the investment process, increases efficiency, and draws attention to potential capital erosion or appreciation that can be harder to systematically identify.

[Related: How PMs Uncover Blindspots With Modern Dashboards]

Data Underutilization

While the market advantages of new and diverse datasets are real, the reality is that portfolio managers at any given moment are tasked with making smart, timely decisions by correlating signals across an increasing number of internal and external sources. An RMS helps make sure all this data — data costing hundreds of thousands, if not millions, of dollars — is seen by the right people, at the right time, and in the right context.

[Related: How Firms Prevent Data Overload & Avoid Underutilization]

Lack of Insights on Missed Opportunities

It’s easy to learn from wins and losses that entered the portfolio. What about ideas that weren’t acted upon? Many funds realize they can and should be getting as much feedback as possible, as quickly as possible, so they can make sure they are always improving. By creating a system of record, a modern RMS provides insights across the board.

[Related: How Portfolio Managers Keep Track of Their Portfolio With an RMS]

Disruptive Compliance

If you’re at a growing fund, you may be juggling compliance and PM duties. An RMS can almost immediately take an immense burden off. If you have a dedicated compliance function, an RMS can give the control and access they need to build — and prove — compliance without getting in the team’s way.

[Related: How an RMS Automates Compliance Reporting]

Knowledge Loss & Long Onboarding Runways

When analysts go elsewhere, their knowledge, perspectives, and research history often go with it. Ramping up a new analyst can take a lot of time. With a modern RMS, new analysts can access the network of information, with context, and start contributing quickly.

[Related: Using an RMS to Secure IP and Improve Knowledge Capture & Retention]

Inefficient Processes & Clunky Workflows

Some funds combine multiple tools for their research management, tools never built for institutional investors. Others must hop in and out of their RMS — whether updating models or generating ideas. Rather than fracturing workflows and cobbling together multiple tools, investment teams use a modern RMS to bring cohesion to their fund workflows and speed to the decision-making process.

[Related: 5 Firm Workflows That Drive Operational Alpha]

Time Lost to Report Generation

Similarly, creating reports and audit trails is especially cumbersome when investment research is stored in numerous places — across siloed teams and shared drives. With an RMS, all that information is conveniently centralized. Users can generate robust reports with the click of a button.

Finding the Best RMS: 6 Considerations

What system is right for you? Aside from comparing core features and making sure the team likes the overall look and feel, here are six questions to consider that speak to the tradeoffs.

How Protective of Your Process Are You?

In other words, are you happy with what you’re doing and want to retain it to the nth degree? Or are you less than satisfied and turning to an RMS to add some structure?

If you’re currently using an RMS and happy with your process, talk to providers to get a sense of what they can bring to the table, how well they can flex to suit you, and what customizations and accommodations you can expect.

If you’re looking for guidance or are coming from a mixed toolset (OneNote, shared drives, etc.), an experienced RMS provider can offer recommendations and introduce universal best practices to help level up your workflows.

What Other Software Are You Using?

It has become increasingly important your new technology can speak to your existing and future technologies.

Tally up the software your front-office is using. What could an RMS completely replace? What would you want to keep?

For technology you want to keep using, at least in the short term, make sure your RMS has all integrations you need for the individual productivity tools (OneNote, Excel, etc.) as well as the team and fund level tools (such as Teams, Tableau, Sustainalytics).

Do You Want Teams To Access From Any Device, Anywhere?

Whether you want analysts to be able to share, access, and collaborate on content via their mobile devices and tablets or you want to give portfolio managers the ability to bring up their own data and research in the field, many funds are breaking down barriers with an RMS that can go anywhere.

In fact, one director of research pointed out, that mobility was one of the deciding factors for his team. “I wanted a SaaS product that the team could access from the middle of nowhere.”

In hybrid work environments, this mobile RMS functionality acts like digital glue that keeps your teams aligned and moving forward.

As it related to RMS solutions, talk to your provider about the frequency of updates to their mobile app, what feature parity looks like (does the mobile version provide everything the web app does), and what device coverage they have (iOS only or Android too?).

Does ESG Integration Matter To You?

Even if you’re of the mind that ESG is more of an obligation than an alpha-driven opportunity, fund managers are increasingly on the hook to track and report on ESG engagements.

Incorporating ESG adds a layer to research management and investment processes that involves establishing frameworks, scoring mechanisms, approval processes, and handoffs to different parties in the firm — all while tracking the work in its various stages.

A modern RMS will help firms by facilitating workflows that:

- Automate engagement data capture.

- Aggregate ESG data from multiple sources for better context.

- Generate client-ready reports without effort.

[Related: The New Fundamentals of ESG Engagement Tracking]

How Are You Incorporating Generative AI Into Your Process?

A modern RMS will be able to provide access to the benefits of generative AI. While you need to be mindful of its limitations (hallucinations, for example), it has proven invaluable in improving analyst efficiency.

GenAI enhancements in an RMS can assist with:

- Auto-tagging research notes.

- Summarizing research notes.

- Auto-filling note metadata in note templates.

By centralizing your investment research, a modern RMS also positions a firm for AI chat experiences in which you can query all the research content. For example, you might query your research, “Why has Company X been able to grow at a faster rate than Company Z?”

How Much of the Investment Mosaic Do Portfolio Managers Want to See at Once?

Another core benefit of a modern RMS is its ability to aggregate qualitative and quantitative data and arrange it into any number of dashboards. The question for investment teams is, “What data points do you want to see as part of your portfolio monitoring and decision-making?”

Whether that’s market data, holdings data, the latest data from your analyst team, or data from third parties, an RMS can provide a single source of truth among disparate datasets.

What Transition to a Modern RMS Looks Like

If you’re new to the RMS scene, transition is really all about end user adoption. Historically, many research management systems have struggled here because the software didn’t match up to always heightening expectations for usability. Things that matter:

- Do analysts like the RMS interface?

- Is it in the same realm as the prosumer tools they’re familiar with?

- Is it cutting steps out of their workflow and providing more focus?

Funds migrating from another RMS typically have two concerns, says Hoony Youn, CTO at Verity.

- Can you recreate everything I’m already doing?

- How long will it take?

Whether you can recreate everything relies on the flexibility of the software and the provider’s migration experience and capabilities. For example, teams at Verity have migrated from so many providers that they’ve developed special tools and processes.We have dedicated data migration toolkits that we use to migrate specifically from other RMS providers.

In terms of duration, that varies. How much historical data are you bringing over to your new RMS? How many customizations are you looking for? But the average at Verity is 4 to 6 weeks.

For Sixteenth Street Capital, the investment team was quickly up and running with their new research management system. Verity migrated all historical data — from email and their shared drive — in less than a month. New users were logging in to VerityRMS within a week after the contract was stamped.

Bottom Line

The RMS landscape has changed much — and will continue to evolve. Make sure your new system can help your team face the market without missing a step.

Thinking About Updating Your RMS? Let’s Talk

At Verity, we help teams migrate, update, and integrate with VerityRMS.

Contact us today for a demo — or to talk to our team of experts >>

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo